What The Heck Is Regtech?

by Talene Pittaway

RegTech (Regulatory Technology) is an emerging industry that uses technology to help organisations avoid compliance risk and enhance regulatory processes. The result is an increased level of product transparency and a higher level of consumer trust... Translated: Regtech is technology to help businesses ethically create, manage and sell products to people.

Is Regtech the new Fintech (financial technology)?

They overlap but Regtech encompasses and provides solutions to many industries outside of the financial world. Regtech was born from misconduct within the banking and finance industry and is the solution (and bestie) to financial industry compliance which is why the two are so intertwined.

The 2008 Global Financial Crisis was a turning point in the need for and growth of regulatory technology. With the obvious need in the banking and finance sector, it has expanded into any regulated industry including Consumer Goods, Telecommunications, Manufacture, Oil & Gas, Technology and more. And Regtech is set for hyper-growth, anticipated to be worth over USD 55 billion by 2025.

RegTech to Solve Rising Compliance Cost

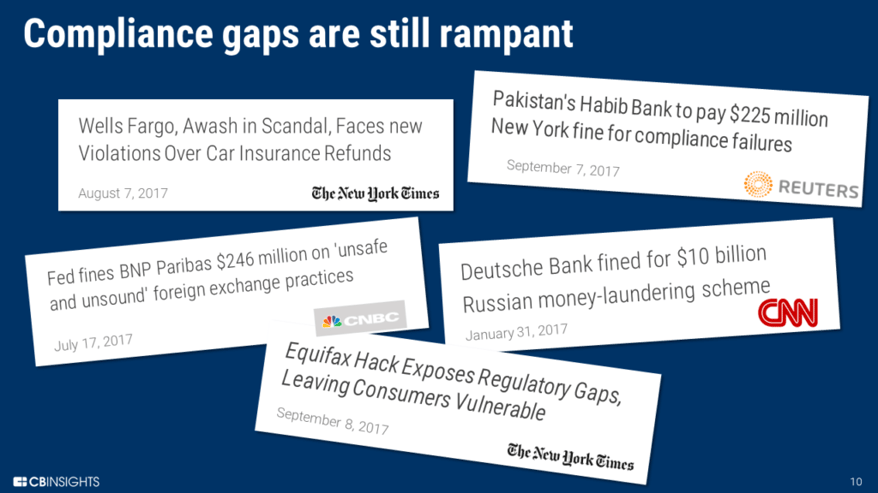

The financial industry has been hit by huge litigation and conduct charges since the GFC, and a knee-jerk reaction to fix this has been to invest in regulation and compliance.

This increasing trend of financial penalty for failure to comply with regulations is expected to drive the need for Regtech further. CB Insights has shown that US banking and finance firms have paid over USD 321 billion in regulatory fines since the GFC - and Australia is soon set to follow US trends in this area.

Findings from the Banking Royal Commission have led to the creation of legislation that will result in fines if regulatory requirements aren't met. The legislation is designed to protect consumers and small businesses.

Okay... so we know financial institutions have been pulled up for misconduct - and Regtech will help them to behave more ethically... but who enforces this? And by when?

The Banking Royal Commission D-Day

ASIC is the body who governs bank and financial institution product compliance - and has the authority to request information and issue stop orders. From 5 April 2021 ASIC's Design and Distribution Obligations (DDO) and Product Intervention Powers (PIP) legislation come into play. In short: Banks and financial institutions have a little over one year to refine product governance otherwise heavy penalties will apply.

RegTech solutions with an analysis of real-time compliance are set to help connect regulators and institutions while protecting consumer interests. Rule changes within this industry have increased 500 percent in the last decade. In fact, a new regulatory update is implemented every 7 minutes. This need for real-time transparency is as important as ever.

Consumers aren't the only ones to benefit from these changes. A stable regulatory framework will help boost GDP growth by more than 2% according to a World Bank report. It is a win-win for everyone.

Want to know more about Regtech and Product Governance? Follow Skyjed on LinkedIn, request a demo, and check out our blog here