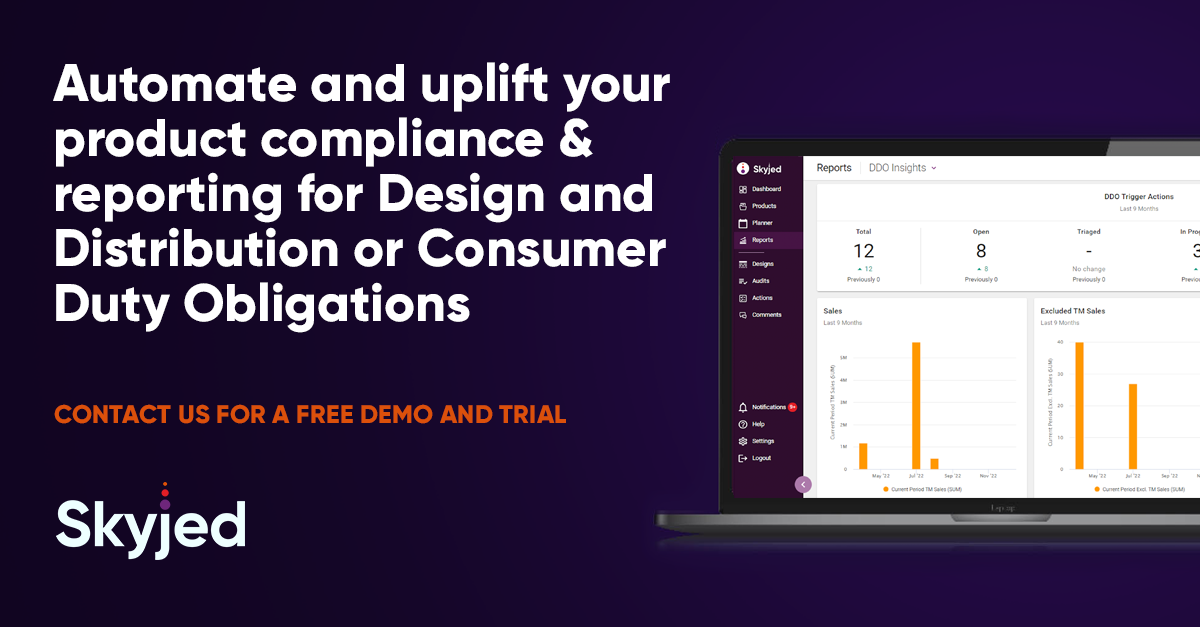

Uplift your product compliance for DDO or Consumer Duty with Skyjed

by Helen Tsaganos

There's a lot to cover in today's post and I have tried to structure it to point you to the areas that you are most interested in.

How can Skyjed help organisations automate and uplift their compliance and product monitoring obligations or even better to know the health and performance of your products? Is it important to know where your greatest risks greatest growth opportunities lie?

1. First, if your time poor but want to know how Skyjed can help with DDO or Consumer Duty, check out Skyjed's one-minute demo video. If you want to know more after watching the short video, contact us for a free no-obligation consultation including a detailed demo.

2. Learn more about the latest ASIC's enforcement and regulatory report and enforcement priorities for 2023 including an update on stop orders and learnings to date. This deep dive aims to guide you on where to focus with the ultimate goal to improve how your products and organisations are delivering product trust and protecting consumers from harm in the financial services industry.

3. Learn more about Skyjed's key feature set for DDO and Consumer Duty - we detail at a high level the top features that provide our customers with the tools to automate and uplift their compliance and product monitoring health.

1. Skyjed DDO / Consumer Duty video (one minute)

2. ASIC's enforcement and regulatory report and enforcement priorities

In its latest enforcement and regulatory report (REP 757) released 15 February 2023, ASIC has underlined its focus for 2023 and warns it will be targeting greenwashing, predatory lending and misleading insurance pricing promises this year.

So what are some of the key insights and messages from ASIC's latest report?

To summarise the key insights include:

- ASIC's has outlined its enforcement focus areas and priorities for the balance of 2023

- There were 22 DDO stop orders in 2022 of which 14 were in the last quarter - October to December 2022.

- There was $222 million in civil penalties resulting from ASIC action in 2022.

- Greenwashing predatory lending and misleading insurance pricing promises ranks amongst ASIC's top priorities - which are partly or all related to the Design and Distribution obligations.

- ASIC warns financial services organisations enforcement focus and actions will continue and grow in order to ensure protection of consumers.

Now lets unpack the insights further.

The latest ASIC enforcement and regulatory report outlines in detail the list of enforcement priorities for 2023 and highlights the actions from October and December 2022 and a summary of enforcement outcomes covering July and December 2022.

It’s fair to say that ASIC is demonstrating continual commitment in seeking to protect Australians from financial harm through various regulatory obligations including the compliance monitoring of the Design & Distribution Obligations.

Enforcement is going to be a continued fundamental part of ASIC’s work as evidenced with the latest report with the primary goal of ensuring consumer protection.

"In the final three months of last year we commenced a number of significant enforcement and regulatory actions to address misconduct, market integrity threats and consumer harms in sectors including financial services, retail and crypto assets". Ms Court said.

"This includes corporate governance and directors’ duties, product design and distribution, and misleading statements involving sustainable finance practices."

Enforcement priorities for 2023

ASIC released their enforcement priorities for 2023 where for the first time has identified areas of “enforcement focus” which they now intend to provide annually.

The priorities, which include the Design and Distribution Obligations (DDO) at the top of the list allows the industry to be made aware of ASIC’s plan and focus.

ASIC’s priorities fall into three objectives and categories:

1. protecting consumers;

2. responding to emerging issues and;

3. maintaining market integrity.

The 2023 ASIC priorities are:

- Enforcement action targeting poor design, pricing, and distribution of financial products.

- Misleading conduct in relation to sustainable finance including greenwashing.

- Misconduct involving high-risk products including crypto assets.

- Combating and disrupting investment scams including working with other regulators, industry, and social media platforms to reduce consumer harm.

- Protecting financially vulnerable consumers impacted by predatory lending practices or high-cost credit including conduct by unlicensed or 'fringe' entities.

- Misleading and deceptive conduct relating to investment products that obscure the risk, performance, or nature of financial products.

- Misconduct in the superannuation sector including misleading conduct and poor governance.

- Failures by providers of general insurance to deliver on pricing promises to consumers.

- Misconduct that involves misinformation through social media about investment products, including 'influencer' conduct.

- Governance and director's duties failures including those related to property schemes that expose investors to significant loss.

- Manipulation in energy and commodities derivatives markets.

- Unfair contract terms including in insurance products.

Design and Distribution Obligations are listed at the top of the list

The objective of DDO is to reduce harm caused to consumers for financial services products due to poor product design and distribution. The obligations drive compliance and allow ASIC to access their regulatory took-kit, including court-based enforcement action, disruption, and using the DDO stop order power, to prevent consumer harms and help organisations ensure their products are consumer-centric.

There were 22 DDO stop orders in 2022 of which 14 were in the last quarter - October to December 2022. This represents an increase of over 60% compared to the prior reporting period.

The enforcement action shows that ASIC will continue to focus on compliance given that the industry has had sufficient time to bed down their implementation of DDO.

ASIC has demonstrated that intervention can improve target market determinations and areas of concerns.

In December, 2022 ASIC published a snapshot report following a review into small amount credit lenders compliance with DDO. Report 754 demonstrates that lenders had made improvements to their target market determinations (TMDs) following ASIC intervention.

The report was mostly focused on small amount credit contracts (SACCs) due to the overrepresentation of financially vulnerable consumers accessing these products, leading to high risk and probability of consumer harm.

It was found that SACC lender's TMDs lacked detail in descriptions of their product and target market. In addition, their product review triggers were not suitably granular to be insightful to have early warning of potential areas of concern for a product being distributed.

Whilst the report focussed on SACC lenders, it is strongly encouraged that all credit providers review the learnings and recommendations from the report when drafting and reviewing their TMDs.

ASIC’s areas of concern when creating or reviewing and updating TMDs include:

Product descriptions

The report highlighted that the typical legislative definition of small amount credit contracts was used to describe the product. In most cases these definitions are insufficient at describing key features and attributes of the specific product.

Defining target markets

Many used descriptions of consumer classes that were too broad to be meaningful. Credit issuers will be in breach of their obligations if they do not provide enough detail in describing their target markets.

Setting trigger reviews

These were also found to be too broad and unlikely to lead to reviews of TMDs where a review would be appropriate and were therefore considered ineffective. Review triggers must establish events and circumstances that would reasonably suggest that the target market may no longer be appropriate.

ASIC will continue to review TMDs, governance documents and data collected by credit lenders from their periodic and trigger reviews. This work is part of a collection of TMD surveillances ASIC is undertaking to ensure the credit industry is designing and distributing financial products that are likely to meet consumers’ likely needs, objectives and financial situation.

Regulatory developments timetable

ASIC has published a regulatory developments timetable for the first time alongside the latest report. Financial organisations can foresee when ASIC will issue draft or final guidance, or the making of a legislative instrument.

Among the 18 initiatives listed for the first three months of this year is the planned release of a new information sheet regarding superannuation trustee transparency and disclosure obligations. It will also have a strong focus targeting sustainable finance practises and disclosure of climate risks, financial scams, cyber and operational resilience, and investor harms involving crypto assets throughout 2023.

“We take our role to protect consumers and investors seriously and won’t hesitate to take action to protect consumers where we identify poor conduct,” Ms Court said.

“We will also remain focused on helping industry to meet their legal obligations by providing simple, effective and easy-to-access guidance.”

3. How can Skyjed help with DDO or Consumer Duty?

Skyjed is an award-winning product lifecycle management and governance software revolutionising the product and RegTech space. Our platform utilises AI-powered technology to give a 360-degree view of product health and performance.

Skyjed has a complete end-to-end DDO solution available for Issuers and Distributors including the designing, sharing, and monitoring of new and existing product target market determinations and product monitoring and reviews.

Background

DDO or Consumer Duty has been designed to ensure that a customer-centric approach is embedded into every financial organisation as part of a Product Governance framework and to ensure the protection of consumers and product trust.

Financial products need to be designed to meet the needs of each target market and ensure they are suitable. They also need to be distributed in a targeted way. Monitoring and reporting need to be in place to ensure that if products digress from the target market determination or design, financial organisations have a way to monitor this and take action.

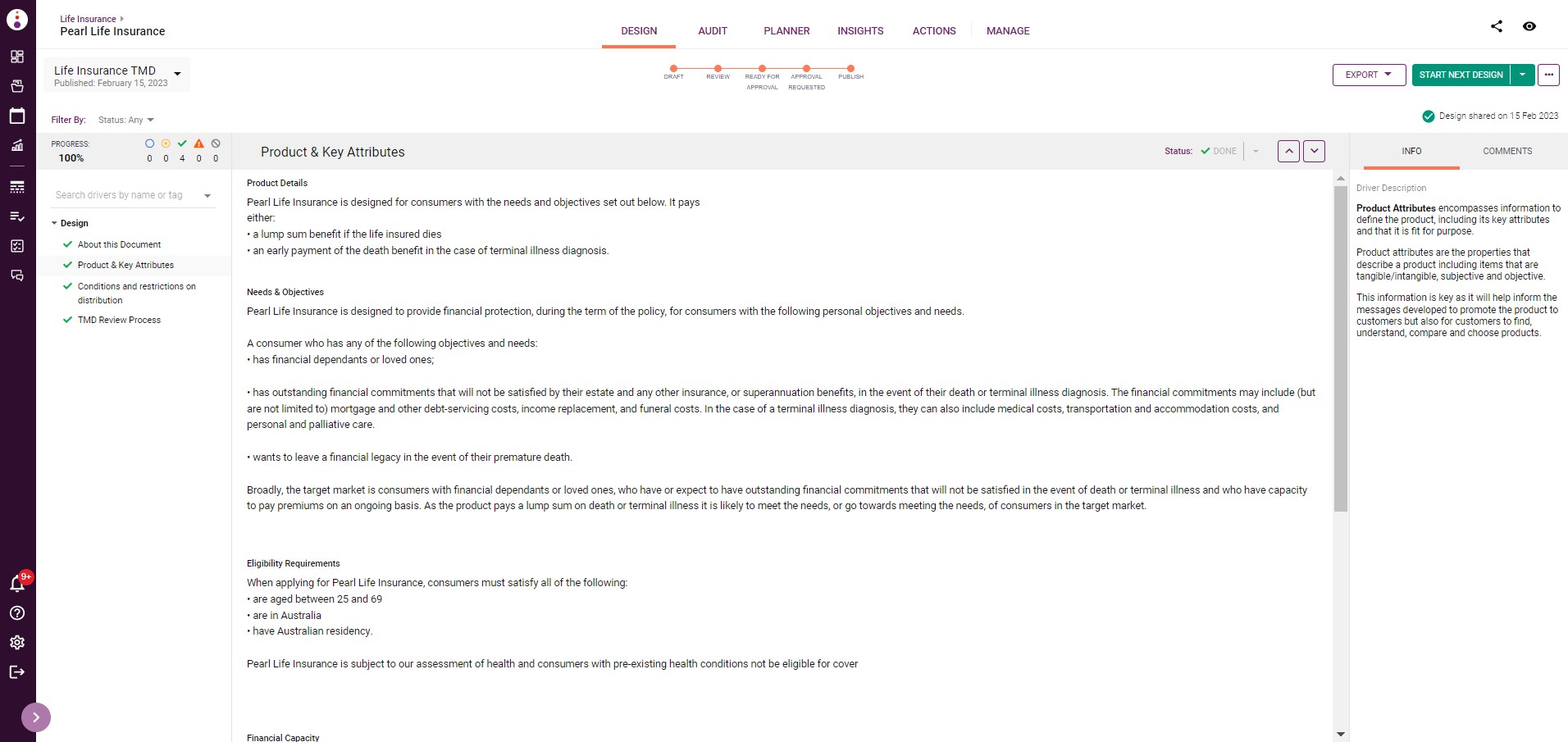

Under DDO, financial organisations (product issuers) are required to create a Target Market Determination (TMDs) in relation to their financial products. In creating a TMD, issuers must consider the design of their products (including the key attributes) and determine an appropriate target market for the product by ensuring that the key attributes of the product are likely to be consistent with the likely objectives, including the financial situation and needs of the target market.

Consumer Duty has similar provisions and requirements to the Design and Distribution Obligations.

Skyjed has a complete end-to-end product governance solution available for financial organisations including the ability to design, share, and monitor new or existing product target market determinations and reviews.

With several features designed to save time and enable your teams to work smarter Skyjed’s solution meets all your product governance and management of DDO or Consumer Duty including target market design and monitoring, governance reporting, automated reminders and planning, automated triggers for monitoring your TMDs and actions/risks management plus more.

Here's what some of our financial customers are saying about Skyjed

Skyjed DDO and TMD Tool Kit

1. How to develop a Target Market Determination and what to cover.

What goes in a TMD?

- Target market description

- Distribution conditions

- Product Review Triggers

- Product Review Frequency

- Distribution information

Develop your TMD in the platform - share, review and approve/publish

Export your TMD in a branded document template or Word/PDF

2. Design and Distribution Obligations Checklist

Product governance and oversight ensure that your customers' interests take on central importance throughout your product lifecycle decisions. We have designed a Chief Product Officer's governance checklist for setting out the processes and controls that help you design propositions and products that customers value.

This checklist is especially useful for implementing product governance to meet the requirements of ASIC’s Design and Distribution Obligations (DDO).

3. Skyjed’s DDO and TMD Masterclass Series.

Checkout Skyjed’s Masterclass series including:

- Creating Best Practise Target Market Determinations

- Solving product distribution challenges for DDO

CEO Leica Ison and Senior Customer Success Manager Sue Sivam-Raja share best practice learnings on how to create Target Market Determinations to ensure they are effective and compliant. Insights include multiple industry roundtables on DDO and how to avoid common TMD mistakes, eliminate ambiguous or broad qualification criteria, and set triggers and thresholds for effective TMD management.

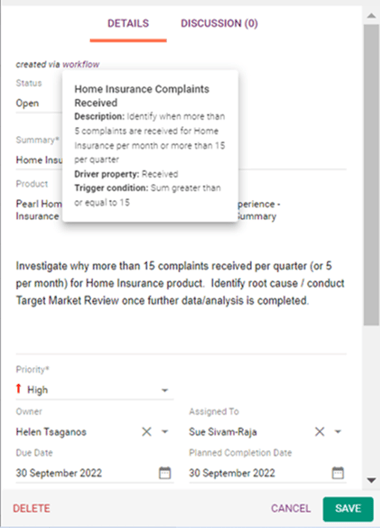

4. Skyjed's Automated Review Triggers workflow solution

Product monitoring trigger workflow s are a way to monitor the strategic or risk events and objectives in your product and will significantly improve your product lifecycle management including early warnings for strategic events including TMD risks, or other important growth levers, competitive intelligence, product performance, and non-financial metrics.

s are a way to monitor the strategic or risk events and objectives in your product and will significantly improve your product lifecycle management including early warnings for strategic events including TMD risks, or other important growth levers, competitive intelligence, product performance, and non-financial metrics.

Skyjed’s platform can automate triggers in a workflow to make the entire product management process faster, strategic, and more efficient. Triggers are ideal for customer complaints, sales data, cancellations, margin decline, market share decline, and so on.

Review Triggers provide advanced warning that you need to adjust your product strategy and goals. We recommend you set triggers around areas like a number of customer complaints, changes in sales volume, and changes in product cancellations as a minimum for example.

Check out Skyjed’s DDO or Consumer Duty demo video

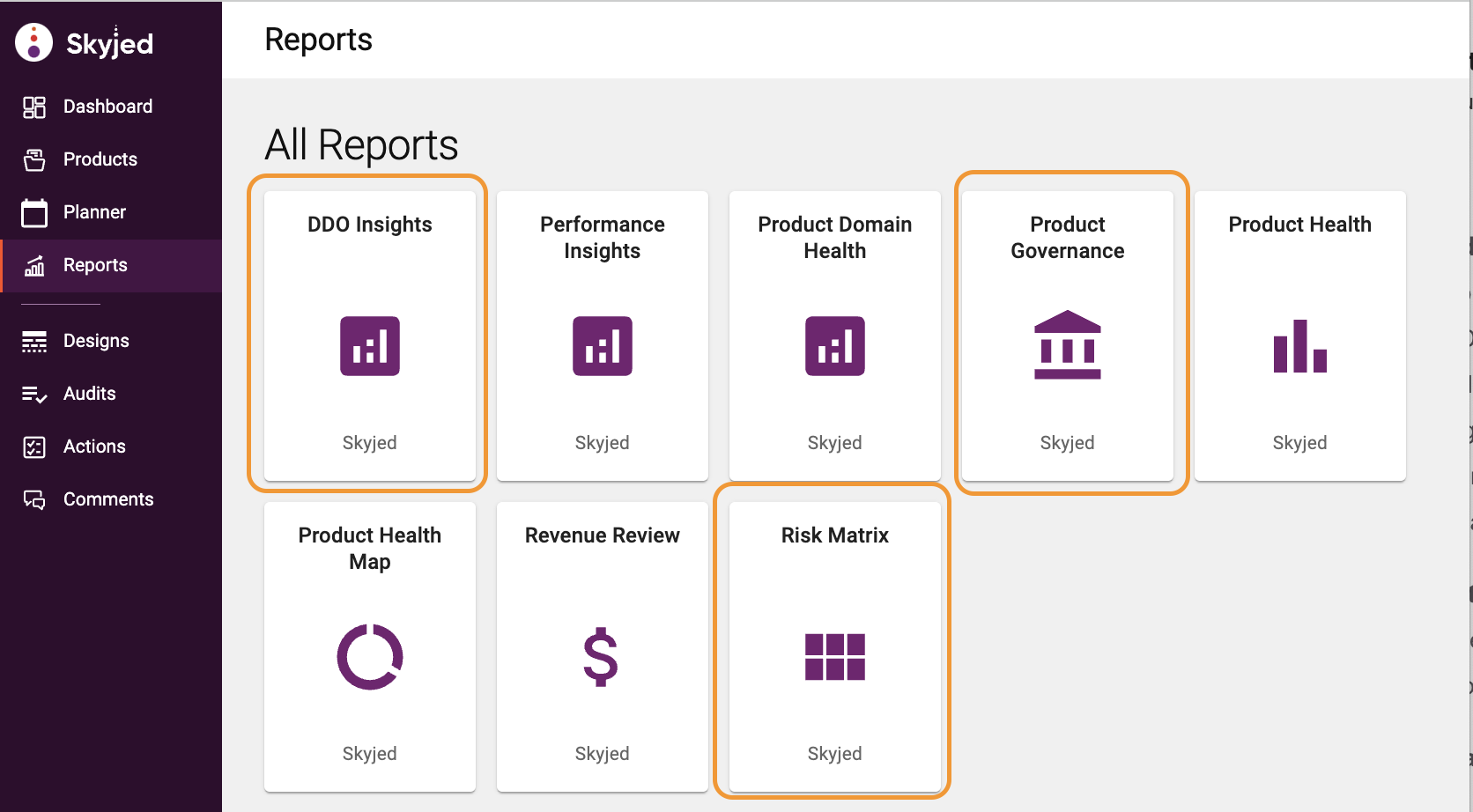

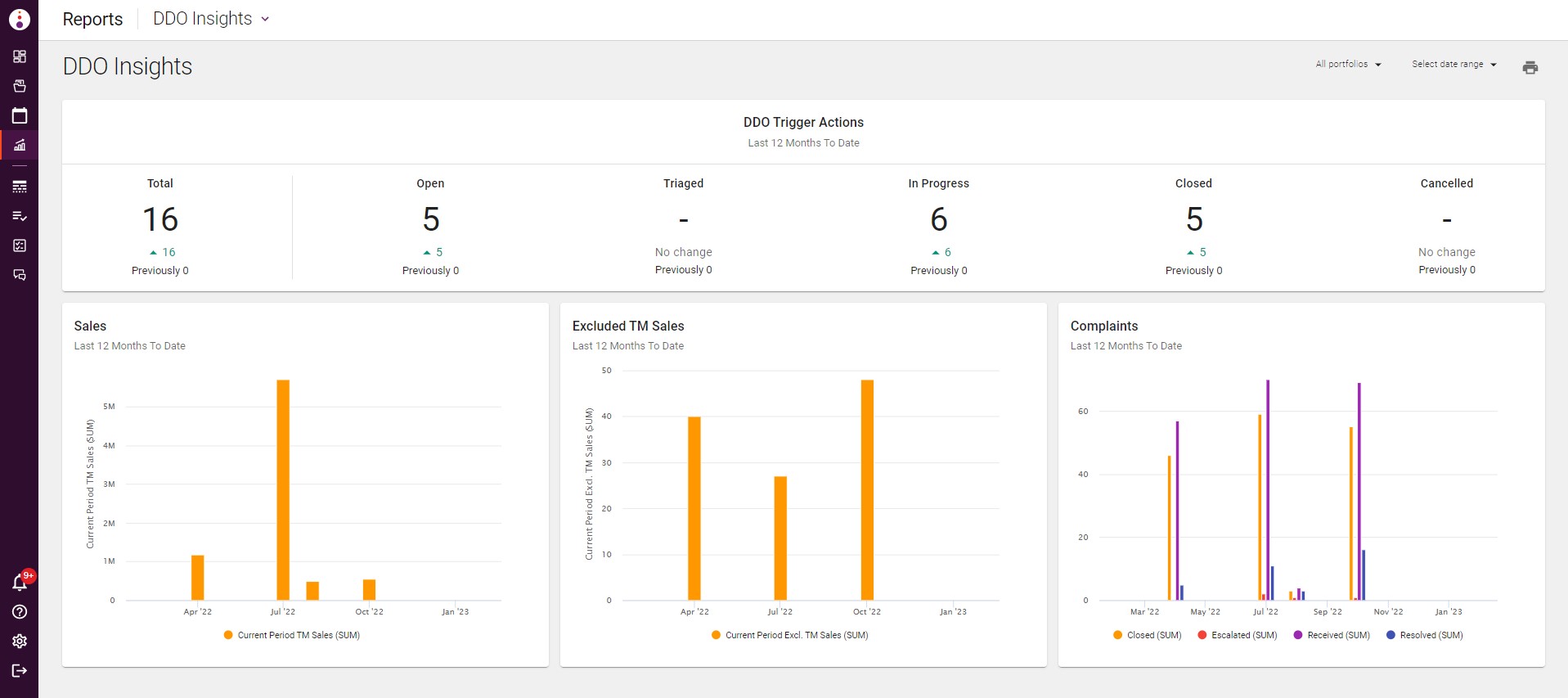

5. Automated Governance and Risk Reporting Dashboards

Skyjed comes complete with a number of automated Governance and Risk Dashboards including product review triggers and product monitoring metrics, TMD reviews etc. Our dashboards enable a deep dive of each of the reported metrics. We can also customise reporting and will shortly have greater report builder features.

Financial Conduct Authority’s (FCAs) Consumer Duty is similar to Australia’s DDO

The Financial Conduct Authority (FCA) regulates the financial services industry in the UK. Its role includes protecting consumers, keeping the industry stable, and promoting healthy competition between financial service providers.

Consumer Duty is made up of an overarching principle and new rules will need to be followed. It will mean that consumers should receive communications they can understand, products and services that meet their needs and offer fair value, and they get the customer support they need when they need it.

Consumer Duty will include requirements for organisations to:

- end rip-off charges and fees

- make it as easy to switch or cancel products as it was to take them out in the first place

- provide helpful and accessible customer support, not making people wait so long for an answer that they give up

- provide timely and clear information that people can understand about products and services so consumers can make good financial decisions, rather than burying key information in lengthy terms and conditions that few have the time to read

- provide products and services that are right for their customers

- focus on the real and diverse needs of their customers, including those in vulnerable circumstances, at every stage and in each interaction

The Consumer Duty represents the biggest change to the retail market and will lead to material changes in the way in which organisations will have to think about conducting their business with retail customers.

For new and existing products or services that are open to sale or renewal, the rules will come into force on 31 July 2023. For closed products or services, the rules come into force on 31 July 2024.

The implementation of Consumer Duty will require firms to ensure they implement product governance frameworks and effective monitoring tools for the ongoing design, monitoring and review of products and ensuring they meet the obligations required to achieve consumer protection across financial services.

Getting product lifecycle management and governance right with the right tools is critical to success.

To get a glimpse of Skyjed contact us for a demo or Skyjed now comes with an automated sign-up with our free Starter Tier (with no payment details needed) and an array of starter features to get you started including:

- A selection of popular ready-to-start product design and product review templates such as Lean Canvas, Launch Ready Review, Product Strategy & Growth, Annual Product Reviews, and more.

- Skyjed's templates guide you every step of the way or you can easily customise your own templates in minutes to suit your business goals.

- Our AI-powered platform enables you to plan, design, monitor, and review your products with product health check scores, dashboards, and insights.

- Collaboration is so easy with your virtual team and includes automated review workflows, automated trigger workflows, actions and comments management, version control, record keeping, and more.

The beauty of Skyjed is that it is flexible to suit your goals whilst enabling product excellence and more time to spend on growth.

When you sign up to Skyjed on any of our tiers, you get access to a selection of best practice Product Design and Audit Templates. These templates have been created using input from product leaders around the world and are designed to help you meet your specific business goals whilst helping you drive towards product success.

Deriving a Product Health Check score is super easy in Skyjed.As you conduct your product reviews using any of our Audit templates, Skyjed’s powerful AI engine will produce a health check score out of 100 as well as insights into where you have opportunities for growth and areas of risk to mitigate.

Measure your product health check scores easily with our Audit Templates and get started today!

About Skyjed

Skyjed is an AI-powered digital product lifecycle management and governance SaaS platform that acts as the single source of truth for product design, health, performance, and governance.

Skyjed is an ISO-27001 accredited solution. It is designed to drive growth and enable product teams to strategically design and monitor products with automation smarts and faster insights to make data-driven decisions with confidence.

Skyjed’s commitment to innovation and our customers has been rewarded with several industry recognitions including Technology of Year – Finalist in the UK Tech & Innovation Awards 2022, Finalist in the AFR Most Innovative Company 2022 and AFR Sustainability Awards 2022 and Regtech Female Founder of the Year 2021.

Experience the unique features of Skyjed:

- AI-powered modern product lifecycle management and governance solution

- Flexible to achieve different business goals

- Pre-built design, monitoring, and review templates or easily build your own

- Automated workflow triggers so you can identify opportunities as they emerge or monitor risks before they take hold

- Access boardroom-ready product governance and product insight reports and dashboards

- Team collaboration with review and approval workflows, actions & comments management, version control, and record keeping

- Integrated workspace with product planning and scheduler capability